Leadership & Management

Adam Tso

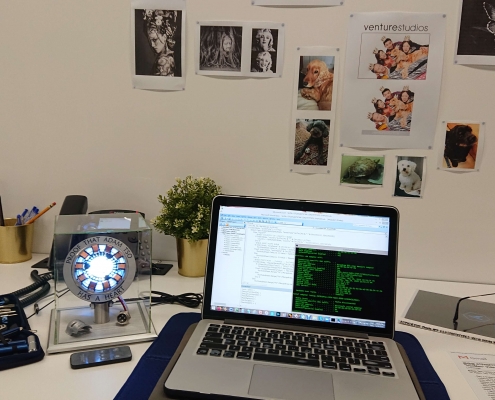

Founder, Chairman, CEO, CTO & Lead Architect

[Master Of The MetaMultiverse]

— ATPHIZYOM — is an “Early-Stage” Tech Start-Up Company based in Hong Kong, founded in 2017, specifically focused on disrupting the global Robo-Advisor & Digital Wealth Management industry by providing TRUE “Autonomization” vs. Existing “Automation” via an algorithmic Metaverse-Ecosystem invented & designed by our Founder (Adam Tso). Ultimately, the purpose is to build the first Metaverse Giant for Gamification & Social Media Networking in the Virtual World of Investing — A Virtual Reality Space connecting the Global Investing Community where people can collectively interact with an Artificial Intelligence-simulated environment and other people synchronously within a synergized ecosystem. ATPHIZYOM is the world’s first Metaverse [Web 3.0] for Augmenting the Human Intellect through Artificial Intelligence-guided Multi-Asset Virtual Investing, Gamification & Social Media Networking.

ATPHIZYOM is an Interactive & Autonomous Digital Platform that combines “Multi-Asset Investment Analysis” + “Social Media & Gaming” [Gamification of Investing] in a Virtual World, via the synergy of Artificial Intelligence & Blockchain Technologies to provide “Customized & Affordable” Investment Solutions to the Average Mass-Market User globally. It is a Globally-Scalable, Geographically-Scalable & Demographically-Scalable Investment Solution — designed for a diverse spectrum of users (ranging from Average Mass-Market Users to Investment Professionals, Millennials to Retirees, etc. — across Age/Income/Skill-Level groups). In essence, ATPHIZYOM is an Autonomous Diversified Asset Management Interface [A.D.A.M.-i], providing Multi-Asset & Multi-Strategy Investment and Financial Management analytic capabilities on its platform via the synergy of Artificial Intelligence and Blockchain Technologies — A.I.-Blockchain-driven Software-as-a-Service [AIBSaaS].

Our Mission is inspired by our Founder’s lifelong dream to merge his 20+ years of professional industry experience from Wall Street, with his technical academic training as a Cornell Engineer, to help “Normalize” Global Income & Wealth Inequalities, provide “Financial Freedom & Independency” to the average mass-market user, and to “Democratize” Wall Street caliber knowledge & resources by offering it as an Affordable Empowering Technology via a Fun-&-Easy Autonomous Virtual Reality Interface accessible at the fingertips of average daily users.

As a former Business Executive and Head of Trading & Distribution for the Asia-Pacific region at the leading Wall Street bulge-bracket firms Goldman Sachs, Morgan Stanley and Bank of America Merrill Lynch, with over 20 years of extensive financial industry and investment analysis & management experience, managing over US$2.3 billion of assets cumulatively, Adam has led some of the largest landmark deals within the regional footprint such as the US$500m Hengan (1044.HK) Convertible Bond IPO. Most recently, he held the role of Chief Investment Officer [CIO] at the Asset Management arm of a HKEX-listed Chinese SOE (state-owned enterprise) Investment Bank.

Independently, Adam is an Engineer, Code Hacker, Private Investor & Asset Manager whose main areas of interest include Technology, Engineering, Mathematics, Astrophysics, Cosmology, Metaphysics, Philosophy, Global Macroeconomics, International Finance and Capital Markets. With a lifelong discipline & expertise in Global Multi-Asset/Multi-Strategy Investing, his genre of investments permeates across the asset classes and combines the merits of a diverse strategy base including Capital-Structure Arbitrage, Event-Driven & M&A, Global Macro and Fundamental-Technical Analysis. His defining style of investments is predominantly target-oriented with above average returns and low volatility/correlation to the broad markets.

A top-tier financier by profession and an elite Cornell University Post-Graduate Engineer by academic training in the fields of Operations Research & Industrial Engineering, Financial Engineering and Computer Science. Graduating “Magna Cum Laude and Valedictorian” of the Masters of Engineering Class, Adam received the <Allan H. Mogensen Award> in recognition of his distinction for academic excellence. In addition to being nominated on the National Dean’s List, Adam is an affiliated member of the <Tau Beta Pi National Engineering Honor Society> and <Golden Key International Honour Society>.