ATPHIZYOM’s True A.I. Ecosystem: “Autonomization” vs. “Automation”

The concepts of “Autonomization” and “Automation” are often confused and used interchangeably in misleading ways by the general public and modern technology businesses to imply the employment of Artificial Intelligence. However, both are completely different technological constructs and only one utilizes, and is associated with, TRUE Artificial Intelligence — “Autonomization”.

“Autonomization” involves the process of introducing Artificial Intelligence into a system in order to replace the Mental Labor (“Thinking”) for human beings, and has only been invented in the past 50-60 years since Artificial Intelligence was first founded as an academic discipline in 1956. “Automation”, on the other hand, involves the introduction of pre-programmed machinery or mechanized apparatuses to replace the Manual Labor (“Doing”) for human beings, and has been around ever since the Industrial Revolution began in the mid-18th century when textile factories were mechanized with weaving machines, newspaper publishers mechanized with printing presses, public transport railroads were mechanized with steam-engine locomotives, all the way until the modern-day household microwave ovens with pre-programmed heating timer settings and air-conditioners with preset temperature control settings. Hence, in order to correctly differentiate between the two complex technological concepts, one can simply ask the question: Is the mechanical system or machine just “Doing” or is it “Thinking” for the human being? A typical example where “Automation” is misrepresented as “Autonomization” is seen in some existing alleged FinTech business innovations which claim to use “Artificial Intelligence” to update financial analytical models based on updated quarterly-published corporate earnings data, when in actual fact, the system processes are merely mechanized by using Static pre-programmed “Data-Entry” algorithms to substitute for the manual labor of data-processing and data-input.

“Autonomization”, which is based on using Artificial Intelligence models to implement technology, is by definition Dynamic & Interactive in nature. On the contrary, “Automation”, which is based on using the process of mechanization to implement technology, is Static in nature. True Artificial Intelligence models are designed to specifically mimic the Behavior, Mentality and Learning Processes of human beings. In reality, different “Brains” will behave, think and learn differently (given the same environmental factors and external data inputs, or even with the identical genetic constitution) — the classic human evolutionary analogy of “Nature versus Nurture”. Hence, in order to create a TRUE Artificial Intelligence model that replicates that unique quality of the human mind, the A.I. Model needs to be customized on a “Per-User” level, i.e. Non-Generic, so that the A.I. Model output is contingent upon the individual User’s type of interactions and unique behavioral usage patterns with the A.I. System and not strictly on the data inputs (identical data inputs may result in varying outcomes). In stark contrast, Automation that involves a mechanized model is Generic by definition since the process is designed for consistency; repeated inputs of identical data will produce the same outcome each and every time. Furthermore, to accomplish the objective of being “Non-Generic” and to successfully mimic the Human Learning Process, a TRULY “Autonoumous” A.I. Model must be Continuously & Dynamically Variable in nature — the A.I. System independently learns by continuously revising and updating its own A.I. Models in real-time based on changing activities and interactions from its end-users and peripheral environment. As renowned physicist Albert Einstein ingeniously once said, “Insanity is doing the same thing over and over again and expecting different results”; hence, “Automation” was never meant to be the be-all-end-all solution, and “Autonomization” was always the natural step forward towards realizing the ultimate end-solution. In the historical past, Mankind’s progress and development has always been dictated by “Automation” via Man’s mimicking of Machine’s superior strength, speed, efficiency and computational capacity. Nevertheless, Mankind’s present and future generations of human evolution will instead be dominated ubiquitously by “Autonomization” via Machine’s mimicking of Man’s behavioral patterns, mentality, learning capacity and spirituality.

Ultimately, any form of “Autonomization” technology that involves utilizing a TRUE Artificial Intelligence model will eventually require a proper Machine Learning process and environment to be in place. At the minimum, a TRUE A.I. Machine Learning process and environment would possess the below THREE critical aspects which are intrinsic to the ATPHIZYOM Platform:

[A] Appropriate A.I. Model

The ATPHIZYOM Platform is essentially an interactive Autonomous Investment and Financial Management Platform that provides big-data behavioral analytics crowdsourced from an indigenous A.I.-driven/A.I.-managed ecosystem (ATPHIZYOM Artificial Intelligence Ecosystem [AAIE]) and a native Blockchain-based social network (ATPHIZA Social Network [ASN]). Being the quintessential “autonomous” investment and financial management solution, it utilizes Artificial Intelligence models to resolve TWO principal investment dilemmas for its Users:

Asset Selection

Asset Allocation

By design, the ATPHIZYOM A.I. Model is Continuously & Dynamically Variable in nature, in order to achieve the objective of being a TRUE Artificial Intelligence model. The inherent stochastic models employed by the ATPHIZYOM A.I. Model consist of:

Multivariate Data-Analysis

- Continuously changing number of input variables contingent upon the User’s interactions and behavioral usage patterns with the ATPHIZYOM Artificial Intelligence Ecosystem [AAIE] and ATPHIZA Social Network [ASN].

Heuristic Simulation

- Trial-&-Error based process by definition which does not rely on a fixed “Static” model, therefore the analytical model is continuously revised in real-time with updated input data, e.g. two different Users with identical Asset Selections and Risk-Reward Preferences input-data may be given completely different Asset Allocation output-solutions, subject to their individual interactions and behavioral usage patterns with the ATPHIZYOM Artificial Intelligence Ecosystem [AAIE] and ATPHIZA Social Network [ASN].

Much like how a human child learns about the physical world and matures over time by interacting with the surrounding environment it inhabits in, ATPHIZYOM’s TRUE Artificial Intelligence model learns and optimizes the “Thinking” and “Behavioral Patterns” of its Users gradually by interacting with the native ATPHIZYOM Artificial Intelligence Ecosystem [AAIE] and the indigenous ATPHIZA Social Network [ASN].

[B] Data-Collection Platform & Data-Base Repository

In order to conduct proper Machine Learning, a suitable platform structure and ecosystem to collect appropriate and relevant big-data behavioral analytics needs to be in place. Each ATPHIZYOM Platform User (“Ad-Sponsored Free-User” or “Paid-Subscriber”) is known as an ATPHIZA, and each of whom is part of a vast collective community network known as the ATPHIZA Social Network [ASN]. Each “ATPHIZA” essentially forms a node within an immense network of nodes, acting much like neurons interlinked by synapses within the human brain, mutually sharing and collecting information from each other whilst simultaneously transmitting Big-Data Analytics in an autonomous and subconscious fashion with the assistance of ATPHIZYOM’s proprietary A.I.-algorithms (Artificial Intelligence models) operating continuously & dynamically in the platform background.

[C] A.I. Model Training & Learning via Data-Recycling

To successfully complete the A.I. Machine Learning process, an appropriate Machine Learning Environment needs to be created for the collected data to be recycled and used as inputs in the training of the A.I. Models. Specific to the ATPHIZYOM Platform, the holistic interconnecting and interacting ecosystem of ATPHIZAs forms the proprietary Aritificial Cerebral Network [ACN], equivalent to the “Cerebrum” within the human brain that is responsible for cognition and perception — the “thinking” part of the brain. Analogous to the evolution of the human brain over time such that the development of a greater number of neurons and synapses translates directly to greater efficiency, productivity, creativity and mental capacity, the ATPHIZYOM Artificial Cerebral Network and its underlying A.I.-algorithmic models collectively evolve to become more and more intelligent as the number of ATPHIZAs (“nodes”) and Followers-Following (“connections”) increases with the growth of both the User-Base size and interconnectivity of the ATPHIZA Social Network. Furthermore, the inherent challenge-response verification system coupled with direct reward payments via Blockchain-driven protocol tokens (“App Coins”) in a decentralized & distributed fashion would incentivize the ATPHIZA Social Network to grow in size, and thus increase the size of the Artificial Cerebral Network, i.e. the “Brain” capacity of the ATPHIZYOM Platform. In conjunction with this form of Machine Learning occurring at a higher level, Deep Learning techniques utilizing “Artificial Neural Networks” will be concurrently deployed at a deeper level to train the individual User-specific A.I.-algorithmic models. Therefore, the proprietary ATPHIZYOM Artificial Intelligence Ecosystem [AAIE] essentially consists of Multi-Layer Machine Learning [ML-ML] units that construct a “Brain-within-a-Brain”, in order to ultimately enhance and expedite the integral A.I. Training process and resultant A.I. Models.

ATPHIZYOM “Autonomization” vs. Industrywide “Automation”: Enhanced Pareto Optimization

A simple comparison of the mechanics and features of ATPHIZYOM’s Autonomous Investment & Financial Management Platform vis-à-vis Industrywide Digital Wealth Management Platforms (e.g. Robo-Advisors, A.I. Funds [Artificial Intelligence], HFT Funds [High-Frequency Trading], etc.) would illustrate how the ATPHIZYOM “Autonomization” (which uses True Artificial Intelligence) vastly differs from the contemporary Industrywide “Automation”, as well as how the concept of “Automation” is often misconceived and disguised as “Autonomization”. In particular, one major aspect of discrepancy between the two genres of platforms is evident in terms of the notion of Pareto Optimization.

Pareto Optimization involves Multi-Objective Optimization (a multiple-criteria decision making process in the context of mathematical optimization problems) that results in the impossibility of improving one variable without harming other variables. Pareto Efficiency or Pareto Optimality is a state of allocation of resources from which it is impossible to reallocate so as to make any one individual or preference criterion better off without making at least one other individual or preference criterion worse off. The concept is named after Vilfredo Pareto (1848–1923), an Italian engineer and economist, who used the concept in his studies of Economic Efficiency and Income Distribution. The concept has been applied in academic fields such as Economics, Engineering, and the Life Sciences. A Pareto Improvement is a change to a different allocation that makes at least one individual or preference criterion better off without making any other individual or preference criterion worse off, given a certain initial allocation of resources among a set of individuals. An allocation is defined as “Pareto Efficient” or “Pareto Optimal” when no further Pareto Improvements can be made, in which case we are assumed to have reached Pareto Optimality. The Pareto Frontier is the set of all “Pareto Efficient” allocations. Applying this notion of Pareto Optimization in the following analysis to breakdown the quintessential features of each genre of platform, we can easily deduce that ATPHIZYOM’s “Autonomous” Platform is significantly different and revolutionarily avant-garde when compared with contemporary Industrywide “Automated” (or “So-Called-Autonomous”) Platforms.

Existing Industrywide Digital Wealth Management & Robo-Advising Platforms “blindly allocate” its users into a finite number of discretely-distributed “Pre-define” categories based on a pre-determined & static “Template” algorithm. A typical Robo-Advising (or Digital Wealth Management) Platform would request user input for a standardized questionnaire of “Generic” investment criteria/factors (e.g. age, income, risk-tolerance level, initial investment capital, target portfolio return, target wealth, investment horizon, years of investment experience, country of domicile, etc.). Subsequently, the platform system generates and returns an output of an alleged “Ideally Customized” Portfolio Asset-Allocation Scheme for the platform user (often involving only ETFs — Exchange-Traded Funds — as opposed to individual assets due to the platform’s lack of algorithmic-complexity) that is derived from the “Generic” factors via a “so-called-autonomous” algorithm. Such an approach is erroneous on many levels and paradoxical by definition. Firstly, attempting to provide “Customized” output-solutions based on “Generic” input-criteria is a self-contradictory process on its own. Secondly, automating the process of investing in ETFs is at best merely “Automated Passive-Investing” that is misguided as “Autonomous Investing”, or in other words, “Automation” in disguise as “Autonomization” — a redundant, as well as untimely, endeavor to salvage Passive Financial Management in a time when the world, in converse, is swiftly withdrawing capital and resources from this particular style of investing and/or investment management due to its unimpressive investment returns and risk management capabilities. Thirdly, given the narrow scope and limited permutations of input criteria/factors by design, the platform algorithm has limited optimization capacity with regards to each individual user’s profile; in terms of Pareto Optimality, this means that the Pareto Frontier is fixed and bounded by a maximum upper-limit. The limitations in the ability to optimize portfolio asset-allocations for individual users is apparent when considering an example where two different Robo-Advisor (or Digital Wealth Management) platform users of completely different backgrounds input almost identical responses for the required questionnaire of investment criteria/factors:

User-A: Investor Profile

- Age = 45 years

- Profession = [ Medical Doctor ]

- Country of Domicile = [ Hong Kong ]

- Risk-Tolerance Level = 20% Risky / 80% Conservative [or Risk-Scale = 2/10]

- Initial Investment Capital = $100,000

- Target Portfolio Return = 15%per annum

- Target Wealth = $200,000

- Investment Horizon = 5 years

User-B: Investor Profile

- Age = 25 years

- Profession = [ Real-Estate Agent ]

- Country of Domicile = [ U.S.A. ]

- Risk-Tolerance Level = 20% Risky / 80% Conservative [or Risk-Scale = 2/10]

- Initial Investment Capital = $100,000

- Target Portfolio Return = 15% per annum

- Target Wealth = $200,000

- Investment Horizon = 5 years

Given only the “Age”, “Profession” and “Country of Domicile” criteria are different, both platform users will most likely receive an output Portfolio Asset-Allocation Scheme that is identical due to the identical financial metrics provided, and may look something like the following:

User-A: Investment-Portfolio Scheme

- EQUITY = 20% @ ALPHA Equity Fund [ETF]

- BOND = 80% @ BETA Bond Fund [ETF]

User-B: Investment-Portfolio Scheme

- EQUITY = 20% @ ALPHA Equity Fund [ETF]

- BOND = 80% @ BETA Bond Fund [ETF]

Based on such kind of supposedly “Customized” output-solutions for each platform user, we can clearly witness that customized optimization on a “Per-User” level is minimalistic in Robo-Advising or Digital Wealth Management platform solutions in general. Moreover, any further optimization enhancements in these scenarios are quantitatively limited by the following general qualitative aspects of the nature of the above type of output Portfolio Asset-Allocation Schemes (and Robo-Advising or Digital Wealth Management platform solutions on the whole), which may, as a result, engender mismatched user expectations versus actual portfolio performances:

Risk-Tolerance: The risk-tolerance quality is by definition a “Subjective” user interpretation. Quantifying this human emotion with an “Objective” metric or score is paradoxical and misleading. As the proverbial saying goes, “Garbage In, Garbage Out [GIGO]” — a flawed and meaningless input-metric will lead only to a flawed and meaningless output-solution.

- User-A: Risk-Tolerance Level = 20 % Risky / 80% Conservative

- But user may actually prefer Investment-Portfolio Scheme: 15% EQUITY / 85% BOND

- User-B: Risk-Tolerance Level = 20 % Risky / 80% Conservative

- But user may actually prefer Investment-Portfolio Scheme: 33% EQUITY / 67% BOND

Asset-Transparency: Lack of transparency regarding the constituents, performance statistics and featured qualities of the underlying portfolio assets or investments (i.e. ETFs) allocated by the schemes naturally constrains the ability of “Asset-Differentiation” for the platform users.

- User-A: Profession = [ Medical Doctor ], Country of Domicile = Hong Kong

Investment-Portfolio Scheme allocated “so-called-autonomously” by the platform to the user:

- EQUITY = 20% @ ALPHA Equity Fund [ETF]: stock constituents = “ Benchmark Index“

- BOND = 80% @ BETA Bond Fund [ETF]: bond constituents = “ US Govt. Treasury“

However, if given “ Full-Transparency“, user may actually prefer Investment-Portfolio Scheme

- EQUITY = 20% @ DELTA Equity Fund [ETF]

- BOND = 80% @ GAMMA Bond Fund [ETF]

Due to the following “hidden” featured qualities of the underlying assets:

- DELTA Equity Fund [ETF]: stock constituents = “Pharmaceuticals” and “Bio-Techs“

- GAMMA Bond Fund [ETF]: bond constituents = “HK Govt. Bond” and “Asia Sovereign“

Narrow-Scope Optimization & Generalized-Diversification: Given the asset classes (e.g. ETFs) used to generate the output Portfolio Asset-Allocation Schemes are generally-diversified (“Generic & Normalized”) in nature, and limited in product variety and/or scope by design, the platform output-solutions naturally offer minimal capacity for any enhancements in portfolio optimizations in terms of “Performance” and “User-Suitability”. Moreover, since an ETF (or any type of Fund) is by definition a mixture of assets, the platform output-solution which is constructed by definition as a Portfolio of ETFs (or Funds) would realistically create just a “Mixture of Mixtures” that would eventually diversify away any optimized-outperformance. Alternatively, from a mathematical and statistical perspective, due to the Law of Large Numbers [LLN], repeated iterations of any attempted optimization process (minor variations in portfolio weightings, ETF combinations, etc.) will not produce substantial improvements in portfolio “Performance” or “User-Suitability”, as any optimization performance-metric used will theoretically converge to a constant expected mean or average value.

- User-A: Risk-Tolerance Level = 20 % Risky / 80% Conservative

The below Investment-Portfolio Schemes may have almost equal “Risk-Return” Performances:

- 20% EQUITY / 80% BOND

- 25% EQUITY / 75% BOND

- 32% EQUITY / 68% BOND

- User-B: Risk-Tolerance Level = 20 % Risky / 80% Conservative

The below Investment-Portfolio Schemes may have almost equal “Risk-Return” Performances:

- 20% ALPHA Equity Fund [ETF] / 80% BETA Bond Fund [ETF]

- 20% DELTA Equity Fund [ETF] / 80% GAMMA Bond Fund [ETF]

- 20% ALPHA Equity Fund [ETF] / 80% GAMMA Bond Fund [ETF]

- 20% DELTA Equity Fund [ETF] / 80% BETA Bond Fund [ETF]

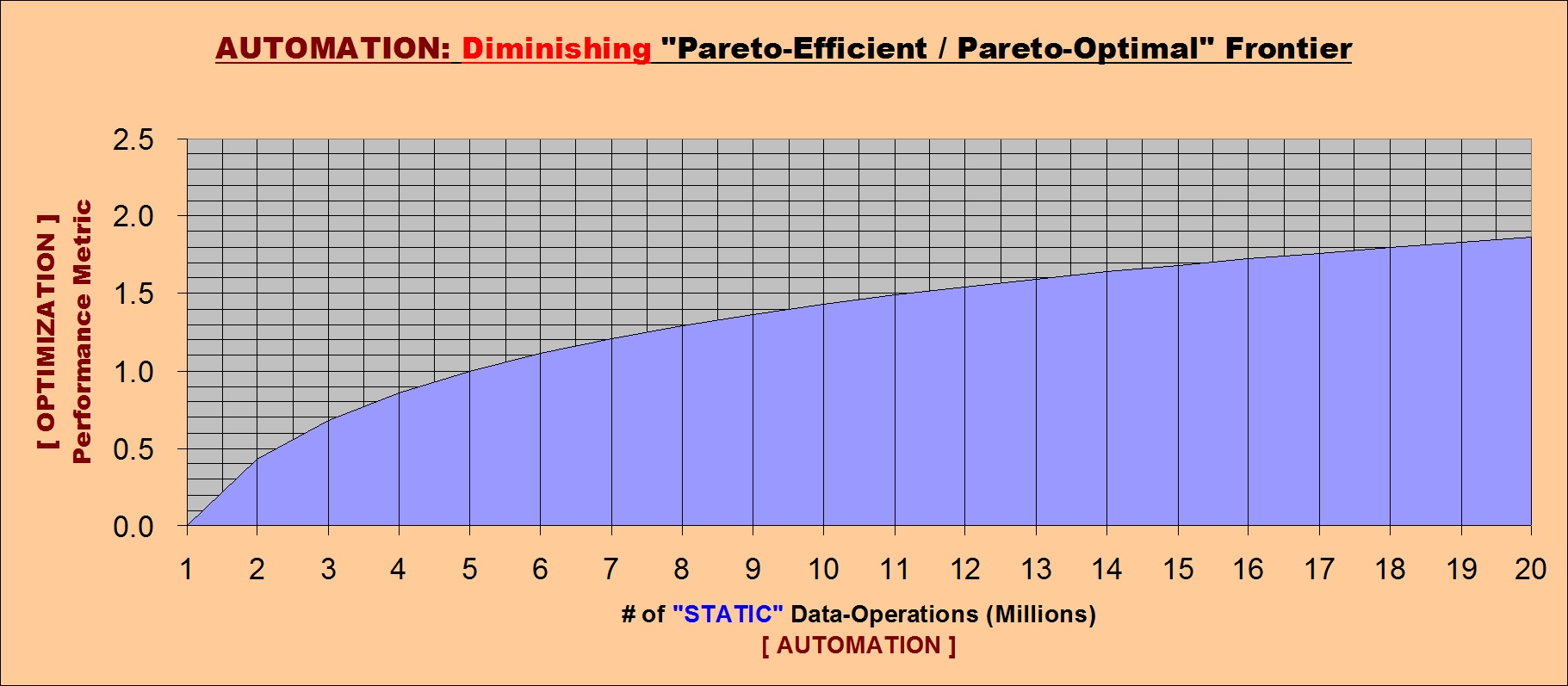

Therefore, given the true nature of Robo-Advising and Digital Wealth Management essentially being an “Automation” process which utilizes objective input factors only, any form of Pareto Optimization is limited by the fact that subjective user qualities are not factored into the algorithmic process. With respect to Pareto Optimization, the mechanics of the “Automation” inherent in Industrywide Digital Wealth Management & Robo-Advising Platforms can be graphically represented by a 2-D Pareto-Optimal Frontier (two-dimensional) with a plateauing peak performance-optimization as “Automation Resources” (number of static data-operations) increase.

In contrast, ATPHIZYOM’s Autonomous Investment & Financial Management Platform allows its Users to “consciously self-allocate” themselves into a theoretically infinite number of continuously-distributed “Unique and Extemporaneous” categories based on a spontaneous & dynamic “True Artificial Intelligence Model” algorithm that builds a new category each time on a Per-User & Per-Usage basis, by profiling in real-time each individual User’s behavioral usage patterns and interactions with the ATPHIZYOM Artificial Intelligence Ecosystem [AAIE]. ATPHIZYOM’s “Autonomous” Platform accomplishes this feat by providing its platform Users with the tools and resources to spontaneously control and truly customize their personal investing experiences, with the assistance of the ATPHIZYOM Platform A.I. — A.D.A.M. [Autonomous Diversification & Allocation Machine / Autonomous Dispersion Analytics Machine], via a mechanism known as “Autonomous With Control” [AWC] that enables them to choose at their own pleasure:

ANY type of Financial Assets they wish to browse or analyze.

ANY type of Portfolio Asset-Allocations they wish to browse or analyze.

ANY type of fellow community Users (“ATPHIZAs”) they wish to communicate with, exchange advice with, follow or be followed by.

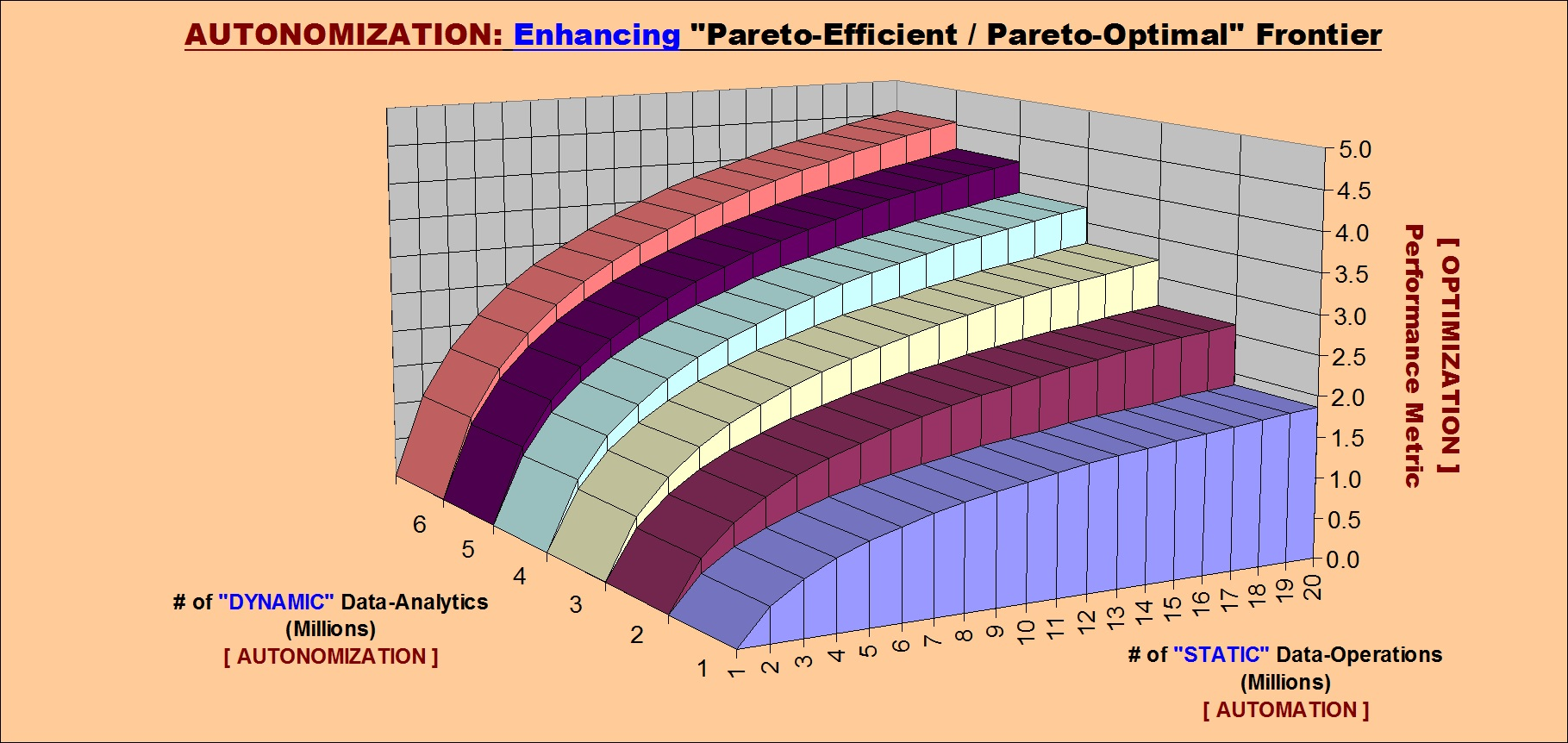

Moreover, this type of Smart-Customization enables further enhanced optimizations on a Per-User & Per-Usage basis to continuously occur over time. With respect to Pareto Optimization, the mechanics of the “ Autonomization” inherent in ATPHIZYOM’s Autonomous Investment & Financial Management Platform can be graphically represented by a 3-D Pareto-Optimal Frontier (three-dimensional) via Pareto Improvements derived from increasing “Autonomization Resources” (number of dynamic data-analytics) that sequentially enhance the 2-D Pareto-Optimal Frontier (two-dimensional) in a positive direction towards higher levels of achievable Pareto Optimization.

Quintessentially, Mankind has in recent history correctly posed the problem of “Autonomous Investing” but incorrectly approached the problem-solving aspect of it, and hence, has so far failed to create a properly suitable and functioning end-solution. Industrywide innovators, researchers and entrepreneurs have all been looking for the solution in all the wrong parts of the “Cause-Effect” chain reaction that drives the overall financial investment framework, by focusing their analytical resources only on the “Effects” (Outcome) domain when the true answer actually lies within the “Cause” (Source) domain. Attempting to extract and deduce “Individual User” behavioral data and analytics indirectly from intertwined and commingled financial market data (which represents an “aggregate/collective” social phenomenon) — the Outcome — is a virtually impossible, improbable and paradoxical process. Nevertheless, from the other end of the spectrum, trying to resolve the problem by extracting and inferring “Individual User” behavioral data and analytics directly from the users individually — the Source — is a much easier, more manageable and realistically probable solution. Ultimately, Mankind has asked the question, and “Mankind” itself is the answer.